On the cusp of retirement, one may think

- “Do I have enough money for retirement?”

- “Am I going to outlive my money?”

- “The world seems pretty uncertain nowadays and that describes me in retirement, too.”

These are all expressing one of the top worries that Americans carry into retirement: having enough cash and investments. While having investments could appear to be the answer, most of us still fret over the uncertainty of investments in the stock market. Will the market be good? Bad?

One way to address the uncertainty is with a technique called Monte Carlo analysis. The Monte Carlo approach incorporates uncertainty by simulating hundreds or thousands of possible future scenarios. Each scenario captures one possible future of the stock market. Some scenarios will have very strong market returns, and some will have a series of bad years with negative returns.

Monte Carlo approach

This is the general approach to run Monte Carlo analysis:

1 – Retirement Scenario: Estimate retirement income and expenses. Retirement income typically comes from Social Security and sometimes a pension. Expenses can be assumed to be constant, or they can change each year. For example, a retiree might want to travel more in the first decade of retirement and then expect to cut back on travel expenses.

2 – Analysis: Run a Monte Carlo simulation to find the “probability of success” of the retirement scenario.

3 – Revision: Adjust the income and expense numbers as needed. And be prepared to re-visit this step several times during retirement.

The results of Monte Carlo analysis come in probability statements like, “the probability of success is 75%.” Another way to think about the result is this: “How likely is it that I need to adjust my spending in retirement?”

We can reframe the result as the “likelihood of needing adjustment”

- High Monte Carlo probability of success => Lower likelihood of needing to adjust expenses later

- Low Monte Carlo probability of success => Higher likelihood of needing to adjust expenses later

Example: A 65-year-old retiree

Let’s look at an example for a 65-year-old retiree with a life expectancy of 95. The retiree will claim Social Security at full retirement age for $24,000/year and expects the following expenses:

- Living expenses: $50,000/year

- Out-of-pocket medical expenses: $5,000/year

- Travel: $10,000/year for the next 10 years

The retiree has $1,000,000 for retirement, half in an IRA and half in a taxable brokerage account. *

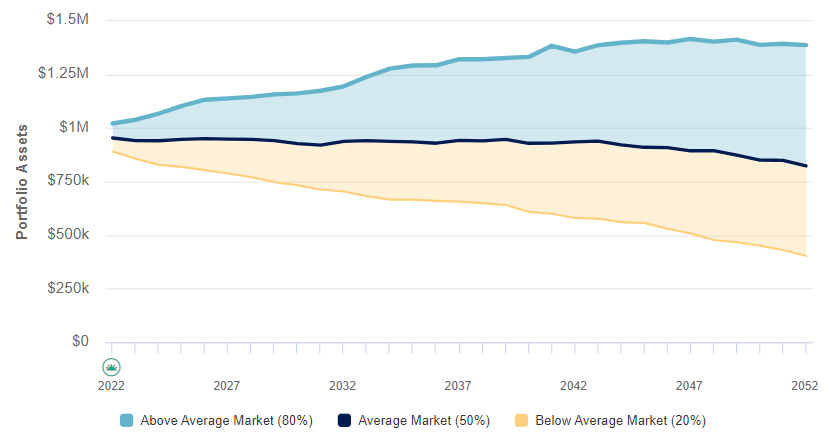

How likely is it that the retiree will have $1 left at age 95? It looks pretty good, with the Monte Carlo analysis giving a probability of success of 96%. So, it is unlikely the retiree will need to change the spending plan. In fact, the retiree might have $400,000 – $1,400,000 left over at age 95 (in today’s dollars) depending on market performance.

Where Monte Carlo analysis can be powerful is looking at different spending scenarios. We can see how the 30-year view might change if spending changes.

| Living expenses | Travel budget (10 years) | Monte Carlo result | Interpretation | |

| Base case | $50,000 | $10,000 | 96% | There is a very low chance that the retiree will need to cut spending later. |

| Spend $1,000 more each month | $62,000 | $10,000 | 59% | There is a higher chance of needing to cut spending later. |

| Spend $1k/mo more, Cut back on travel | $62,000 | $3,000 | 72% | The retiree may need to cut spending later. |

I find that most people know who they are and know which approach they want to take. Some people prefer to spend less to increase the likelihood of their money lasting (without having to make changes later). Some would prefer to spend more today, knowing it means they may need to cut back later if the stock market doesn’t do as well.

Instead of aiming for a specific Monte Carlo probability of success (such as 82% or 90% or 95%), I prefer to talk with each retiree about how they feel about needing to make changes.

* Assumptions: $1,000,000 portfolio with 50% in a taxable brokerage account and 50% in a traditional IRA. Model: Returns average 6.21% and inflation is 2.37%. The retiree lives in a state with no income tax. The Monte Carlo simulation runs 1,000 trials. There are additional factors that should also be considered: basis in the taxable account, withdrawal strategy, other Social Security strategies, tax bracket management, and potential long-term care needs.

The information on this site is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information on this site should not be relied upon for purposes of transacting in securities or other investment vehicles.

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Big Red Abacus, LLC dba Abacus Financial Planning disclaims all warranties, express or implied, including, but not limited to: implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

AFP does not warrant that the information will be free from error. Your use of the information is at your sole risk. Under no circumstances shall AFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if AFP or an AFP authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.