Company stock comes in different forms resembling alphabet soup: ISO, NSO/NQSO, RS/RSU, ESPP, ESOP. In case you’re curious, the initialisms stand for incentive and non-qualified stock options, restricted stock (units), employee stock purchase plans, and employee stock ownership plans.

The details are very important and can have a big tax impact, which can dominate the discussion. Our approach is to collaboratively identify 2 or 3 priorities to guide decisions. Then we dive into the tax details. You can use our equity comp framework to identify what is most important to you.

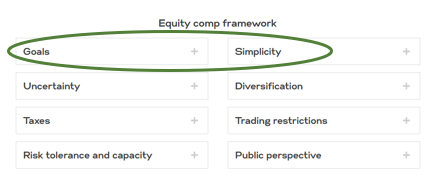

Step 1: Identify your top 2 or 3 priorities.

Equity comp framework

Goals

What are your goals outside of work? How specific are they and how soon do you hope to reach them?

Uncertainty

How do you feel about FOMO if the company stock price goes very high or very low? How long might you stay at the company?

Taxes

What tax bracket are you in now? How would exercising/selling your options impact your tax bracket? How important is minimizing taxes to you?

Risk tolerance and capacity

Consider how stock options fit into your overall financial plan. What will keep you from sleeping at night?

Simplicity

Do you thrive on financial details or prefer a streamlined approach?

Diversification

What other investments do you have? How much is concentrated in company stock?

Trading restrictions

Trading windows and rules may limit when you can exercise or sell. Have you considered a 10b5-1 plan?

Public perspective

For large shareholders, what are the implications of selling company stock, both within and outside the company?

Step 2: Evaluate the combination of your priorities.

Some priorities mesh well together. Some can be hard to combine. Do any of these combinations match your priorities?

Specific goals and High simplicity

This combo is doable! While we will not know the value of the company stock ahead of time, planning to use your company stock to support other goals can be part of a streamlined, actionable plan. Some common goals we see for tech employees are purchasing a new home, paying off student loans, and reaching financial freedom.

Low uncertainty and Minimize taxes

This pairing might be harder to pull off. Strategies to lower taxes typically involve holding options (or the stock) longer to receive preferential tax treatment. Waiting increases uncertainty due to overall stock market changes. Investor sentiment about the company may also change.

Trading restrictions and Diversification

There can be risks to holding a concentrated position in one stock. Enron is the classic example of employees losing their savings when the company collapsed.

Diversifying a concentrated position can require careful planning. If there are restrictions on when you can exercise or sell, it may take longer to reach your target diversification.

High risk tolerance and Minimize taxes

Strategies that prioritize minimizing taxes often require time to wait to meet IRS rules. Waiting longer means there is more time for the stock market to go up or down. It may take a higher risk tolerance to be comfortable during the wait.

Step 3: Make decisions on how to move forward.

When we start from a point of considering each person’s priorities (instead of just their tax return), we can see how two employees with the same stock awards at the same company can make completely different decisions that are the right choice for them.

Our upcoming blog posts will walk through examples.

The information on this site is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information on this site should not be relied upon for purposes of transacting in securities or other investment vehicles.

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Big Red Abacus, LLC dba Abacus Financial Planning disclaims all warranties, express or implied, including, but not limited to: implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

AFP does not warrant that the information will be free from error. Your use of the information is at your sole risk. Under no circumstances shall AFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if AFP or an AFP authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.