When tech workers first get stock options, they may be excited, having heard stories of people making millions with stock options. They may also feel nervous because they’ve heard stories of big tax bills.

We will walk through two different scenarios, with the happy version realizing an overall gain of $750,000, and the sad version realizing an overall loss of $135,000.

The happy tale of incentive stock options typically has three components:

- Receive the stock options with a low exercise price.

- Exercise the options at close to the low exercise price, generating a small (or no) tax liability.

- Then the company zooms to a high valuation, and the tech worker sells it and enjoys the gains in a lower tax bracket.

The sad scenario with incentive stock options is generating a large tax liability before realizing the gains, and then the stock drops in value so you can’t even sell it to pay the tax bill.

Note that these two examples do not represent the full spectrum of incentive stock option scenarios. There could be an even happier happy version and an even sadder sad version, and there are many scenarios in between.

The following technical terms will be used in the scenarios; click on the + to read more about each term. This is an overview of the term and not a full explanation.

Stock option

A stock option gives you the right to buy a specific stock at specific price. There are often rules around the timing of when you can buy the stock.

Incentive Stock Option (ISO)

A stock option with special tax rules depending on the timing of the grant, exercise, and sale of the stock

Nonqualified Stock Option (NQSO/NSO)

A stock option with fewer potential tax benefits than an Incentive Stock Option (ISO)

Exercise

When you exercise stock options, you buy shares of stock at a specific price. An option agreement will specify the price to purchase the stock.

Strike price

The strike price is named in the option agreement and may be called the exercise price. It is the amount you pay to buy the stock under the agreement.

Bargain element

The bargain element is the gap between the strike price and the stock’s actual value at exercise. The bargain element has different tax treatment for different types of options.

Capital gain/loss

Conceptually, a capital gain is the difference between what you sell something for and what you initially paid for it. When you sell it for more than you paid, it’s a gain. If you sell it for less than you paid, it’s a loss.

Alternative minimum tax (AMT)

The alternative minimum tax is a parallel tax computation. The AMT is calculated alongside the traditional tax calculation. If the AMT due is less than the traditional tax due, you owe the amount from the traditional tax formula. If the AMT amount is higher than the standard formula, you owe the higher amount of the AMT. If you owe AMT (or might), it’s generally good to work with a CPA or EA.

The happy version

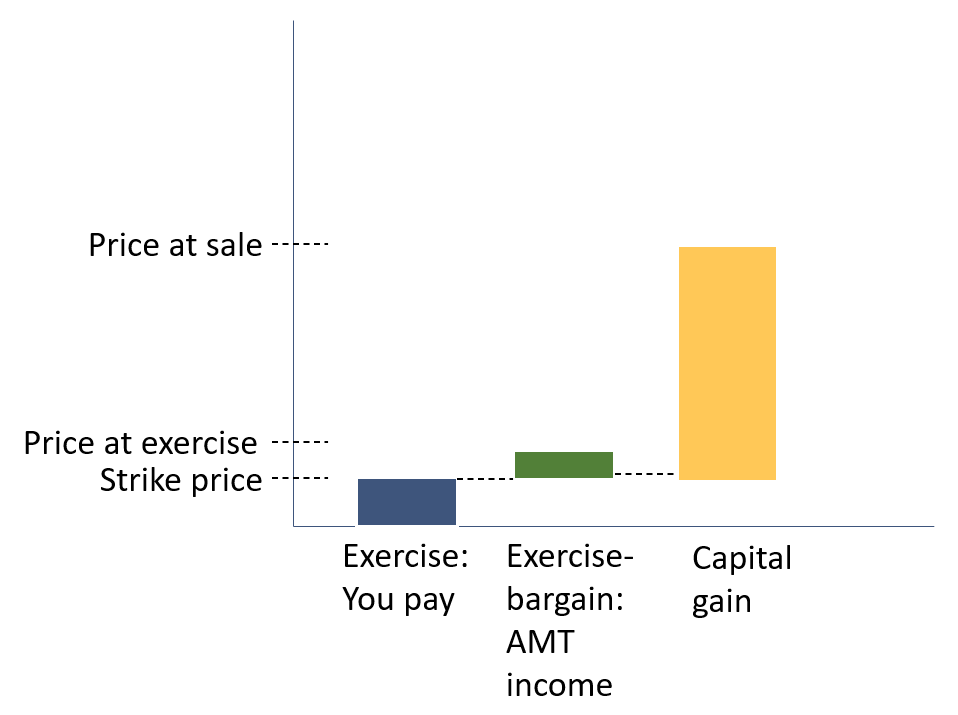

Let’s say you have Incentive Stock Options (ISOs) that allow purchasing 10,000 shares and will meet the conditions for ISO treatment (a “qualifying disposition”). When you exercise the stock options, the strike price of $1/share is just under the prevailing value of the stock, $1.10/share. This means you would pay $10,000 out of pocket to buy the shares (the blue bar), and the bargain element is $0.10 * 10,000 = $1,000 (the green bar). The ISO bargain element is part of the AMT tax calculation. For this example, we assume this (relatively small) ISO bargain element does not trigger payment of AMT tax in the year of sale.

Suppose you meet all holding requirements, and 1-2 years later the stock price has zoomed up to $100/share. You decide to sell the 10,000 shares, realizing $1,000,000 in gross proceeds. The gain is taxed as a long-term capital gain and results in owing an additional $231,534 in taxes.

The net proceeds are over $750,000. Quite a happy outcome!

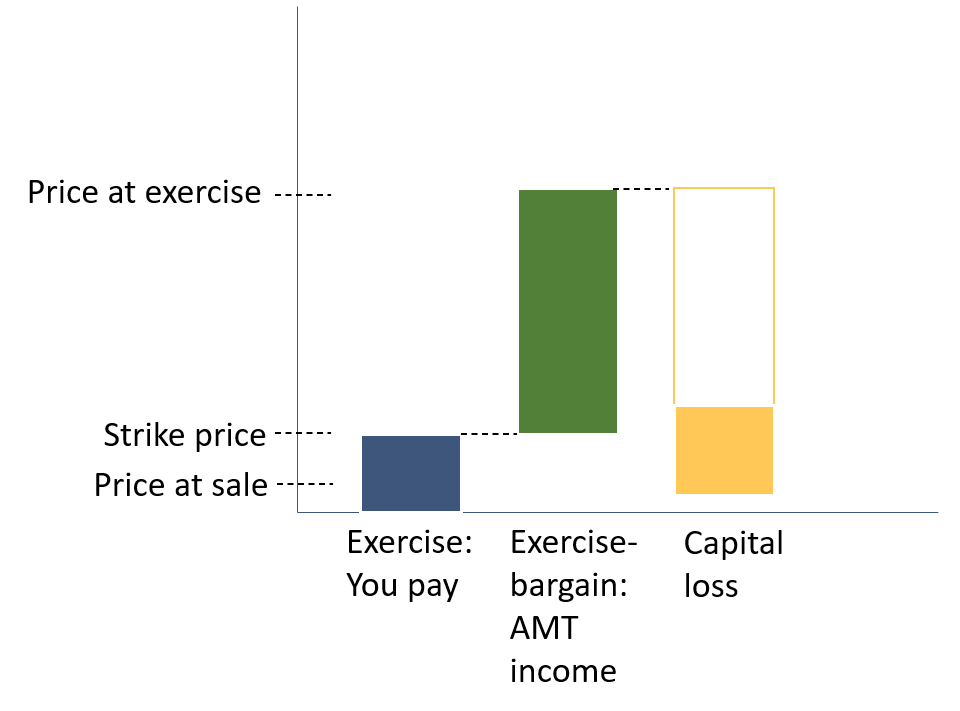

The sad version

Let’s walk through the sad version now. You have ISOs for 10,000 shares and again meet all of the conditions for a qualifying disposition. When you exercise the stock options, though, the value of the stock is $50/share. This gives a bargain element of $49/share, or $490,000 as income in the AMT formula. The resulting tax bill is $130,555 higher than if you had not exercised the options that year.

Again, assume you meet the holding requirements. Then 1-2 years later, the stock price has dropped to $0.50/share. You think the stock will never bounce back and decide to sell all 10,000 shares. The proceeds of the sale are $5,000. This results in a capital loss; while there is a slight tax benefit to a capital loss, it is out of scope for this conceptual example.

Comparing the happy and sad scenarios

| Happy scenario | Sad scenario | |

|---|---|---|

| Out of pocket cost to exercise | $10,000 | $10,000 |

| Additional taxes in the year of exercise | – | $130,555 |

| Gross proceeds at sale | $1,000,000 | $5,000 |

| Additional taxes in the year of sale | $231,534 | – |

| Net overall gain/loss | +$758,466 | -$135,555 |

How can we avoid the sad scenario?

There are some things we can control in deciding which path to go down, and there are some things we cannot control.

Things we can control

- When to exercise

- How many shares to exercise

- How to pay for shares at exercise (with other income/savings or a cashless exercise)

- How to pay the tax bill from exercising

- When to sell the shares

Things we cannot control

- The share price – before or after exercising options

- Possible future tax law changes

The key to avoiding the sad scenario is thinking ahead about taxes before exercising options. If exercising options is likely to result in a large AMT liability, you can consider other strategies, such as selling some or all of the shares to either realize the full gain or at least generate enough cash to cover the expected tax bill.

This comparison should be considered along with the 8 priorities. Someone who wants to avoid uncertainty may want to avoid an unplanned AMT tax bill. Someone who embraces uncertainty and complexity and wants to minimize taxes may strategically exercise options based on the price and a multiyear AMT tax strategy. Someone who values simplicity, other goals, and diversification may exercise and sell on the same day.

When building a plan for your stock options, always keep these in mind: the specific details of the stock plan, your tax situation, and your priorities.

Technical notes: These examples are based on a fictitious stock and stock option. They do not reflect a particular company. There are lots of additional tax details behind the scenes that are simplified here. Review your stock plan in detail, and work with a CPA or EA for tax preparation. The following tax assumptions are used in this example: a married couple with 2 dependents; 1 wage earner with $300k in W-2 income; no other income (no interest, dividends, capital gains, etc.); standard deduction; 2022 tax brackets are used for all tax estimates.

The information on this site is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information on this site should not be relied upon for purposes of transacting in securities or other investment vehicles. The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Big Red Abacus, LLC dba Abacus Financial Planning disclaims all warranties, express or implied, including, but not limited to: implied warranties of merchantability, non-infringement, and suitability for a particular purpose. AFP does not warrant that the information will be free from error. Your use of the information is at your sole risk. Under no circumstances shall AFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if AFP or an AFP authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.