Before diving into a stock option plan, it’s important to decide how the decision fits into a larger financial plan. What are the goals? How much risk is needed or wanted? As discussed in our framework for equity compensation, exercising options must be planned in light of taxes that may follow. The investor cannot control the share prices but can control when to exercise and how to fund the associated tax bill.

If someone wants to

- Minimize taxes,

- is OK with uncertainty,

- and embraces complexity,

this is a strategy to consider: exercise options up to a level that does not trigger Alternative Minimum Tax (AMT) and repeat annually.

Alternative Minimum Tax (AMT)

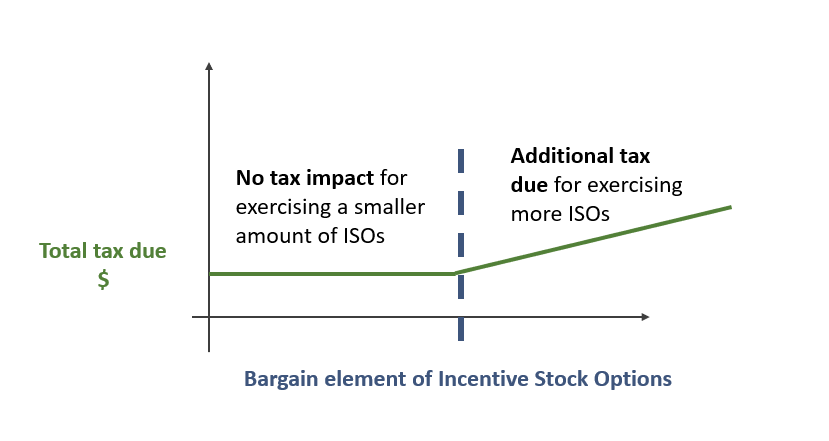

AMT is a parallel tax structure that is computed alongside the regular tax formula. You pay AMT tax when the AMT tax calculation gets bigger than the regular tax calculation.

When exercising Incentive Stock Options (ISOs), the bargain element is the difference between the exercise price and the market price. The bargain element is not a part of the regular tax formula, but it is included in the AMT tax formula. We will refer to this bargain element as “AMT ISO income” because it counts as income in the AMT tax formula.

Example: a single tech work worker

Let’s assume we have a single tech worker who receives stock options. She takes the standard deduction and has W-2 income of $250,000. To keep the example simple, we assume she has no income from interest, dividends, or capital gains.* We will also assume that ISO timing rules are met. If there is surprise income at the end of the year, it can throw off the ISO/AMT calculations. Surprise income could be a bonus, and it could also be interest and dividends from investments. For simplicity, we assume there is no such extra income.

If she does not exercise any options, the AMT ISO income is $0 on her tax return. This table displays several possible amounts of AMT ISO bargain elements:

| W-2 income | $250,000 | $250,000 | $250,000 | $250,000 |

| AMT ISO income | $0 | $40,000 | $50,000 | $200,000 |

| Total tax | $57,171 | $57,171 | $59,076 | $101,076 |

| Additional tax due to AMT | – | $0 | $1,905 | $43,905 |

| Marginal tax bracket | 35% | 35% | 28% | 28% |

With tax planning, we can find the threshold of where the AMT ISO bargain element will kick the taxpayer into AMT territory. For this example, it is around $43,000 of AMT ISO income. It is important to work with a CPA or EA to fine tune the exact number.

When exercising a large number of ISOs, the bargain element may be larger, resulting in an additional tax liability.

Building a strategy

Our tech worker might decide to exercise ISOs up to the point of not triggering AMT taxes. A related decision is how to pay the exercise price (how to pay the costs of exercising the option). Depending on the specific situation, it may need to be paid out of pocket, or there might be an option to sell some shares to pay the costs, often called a cashless exercise.

A caution of exercising ISOs and holding the shares is that it is possible to pay taxes on unrealized income. This can lead to the “sad version” of stock options.

Crafting such a strategy takes time, creates uncertainty, and almost certainly must involve a finance professional. For the investor, the question should be how the strategy matches overall goals and fits into the broader financial plan.

* Assumptions: Single taxpayer in a state with no income tax. 2022 W-2 income of $250,000 and no other income. All holding conditions are met for preferential ISO tax treatment.

The information on this site is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information on this site should not be relied upon for purposes of transacting in securities or other investment vehicles.

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Big Red Abacus, LLC dba Abacus Financial Planning disclaims all warranties, express or implied, including, but not limited to: implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

AFP does not warrant that the information will be free from error. Your use of the information is at your sole risk. Under no circumstances shall AFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if AFP or an AFP authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.