Retirement brings many changes and chief among them is a mind shift from “save and invest” to “pull out money to live on.” Regardless of the amount of savings and investments, the idea of drawing down that total can be worrisome. Your first thoughts may be about all the uncertainties.

- How will the stock market do? When will the next recession start?

- How much will inflation be? How much will my property taxes go up?

- Will I run out of money? What will my medical costs be? What support will my family need?

The language of savings and investments adds to the uncertainty: withdrawal, distribution, draw-down. These words conjure an image of a diminishing pot, one that we can only hope will outlast us. A plan for retirement can counter the worry.

Assumptions for the plan:

1 – My plan can be designed for flexibility in case of catastrophic conditions. If the world changes in a major way (hello, covid!), I will be able to adjust my plan and my finances. Until that time arises, I can follow my plan with just a few tweaks, as needed. (I don’t need to worry about a future recession now. I can change my plan later to meet new demands.)

2 – My plan cannot predict every future expense but I can make short-term predictions that support quality of life decisions. (My annual budget will include money for trips for the next 5 – 10 years. Then I can assign it to another purpose.)

3 – I can create a paycheck for myself, shifting from a mindset of “withdrawing my savings” to “paying myself.” (I always liked having a paycheck and there’s no reason I can’t create a do-it-yourself version. It’s a “DIY” Paycheck.)

Investment-funded DIY Paycheck

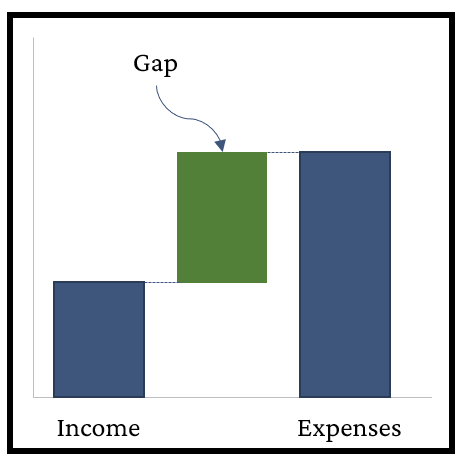

For most of us, retirement income comes in the form of a Social Security payment or a pension. The amount of income is stable with the potential for small cost-of-living adjustments but no other increases. Realistically, we should expect a gap between income and expenses. We will need to use other assets to cover expenses that are sure to go up as we age. The usual assets are a savings account, investment accounts, and real estate. These are the likely sources to fund the DIY Paycheck.

Investment accounts can present both a psychological advantage and disadvantage for the DIY Paycheck. As markets change, investments may continue to grow while DIY Paychecks are delivered. The flip side is that a bear market could shrink the investment account. The realistic expectation is that the investment account will eventually decline but that process may be slowed if the money continues to be invested in stocks and bonds. To support long-term success, finding the right initial withdrawal rate is a key consideration in building a DIY Paycheck.

Predictable, automatic, adjustable

The purpose of the DIY Paycheck is to cover any gaps between income and expenses. The most helpful DIY Paycheck is predictable, automatic, and adjustable.

- Make it predictable, like any other paycheck. An intermittent paycheck may create anxiety but a regular schedule creates confidence. Common patterns are every-two-weeks and every month. But there’s nothing wrong with a weekly schedule if that suits you. You can also time the DIY Paycheck to complement other incoming money. If your Social Security check is deposited on the 2nd Wednesday of every month, you might want to schedule your DIY Paycheck for the 4th Wednesday of the month.

- Make it automatic. With a little pre-planning, the DIY Paycheck can be established as an automatic deposit to the checking account. This plan relieves you of the task (and decision) to move money throughout the year. Even tax consequences can be handled in a systematic way.

- Make it adjustable. The DIY Paycheck is flexible because it is under your control. An annual review of finances permits changes without disrupting the advantages of being predictable and automatic.

Stay tuned for the next blog post about planning for retirement with a DIY Paycheck.

The information on this site is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information on this site should not be relied upon for purposes of transacting in securities or other investment vehicles.

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Big Red Abacus, LLC dba Abacus Financial Planning (AFP) disclaims all warranties, express or implied, including, but not limited to: implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

AFP does not warrant that the information will be free from error. Your use of the information is at your sole risk. Under no circumstances shall AFP be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if AFP or an AFP authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.